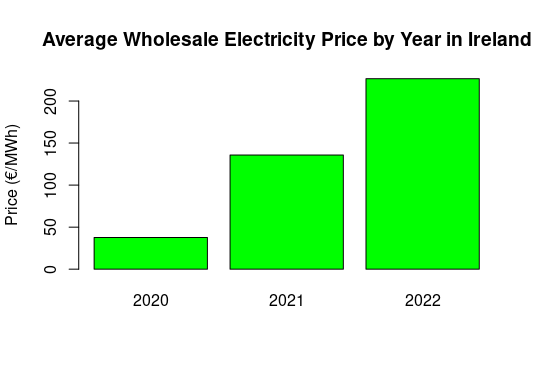

Irish wholesale electricity price have risen substantially over the last few years.

But how does that impact the market for energy storage? The goal for energy storage is to buy low and sell high – profit is determined by the difference (spread) in what you can buy electricity for, and what you can sell it for. Let’s see how the spread has varied by year:

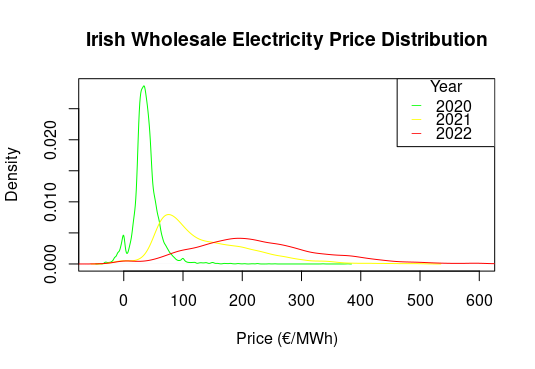

As the above chart shows, not only were prices higher in 2022, but they were also much more spread out. So a storage facility could make a handy profit buying electricity at, say €60 per MWh, and selling at €400+.

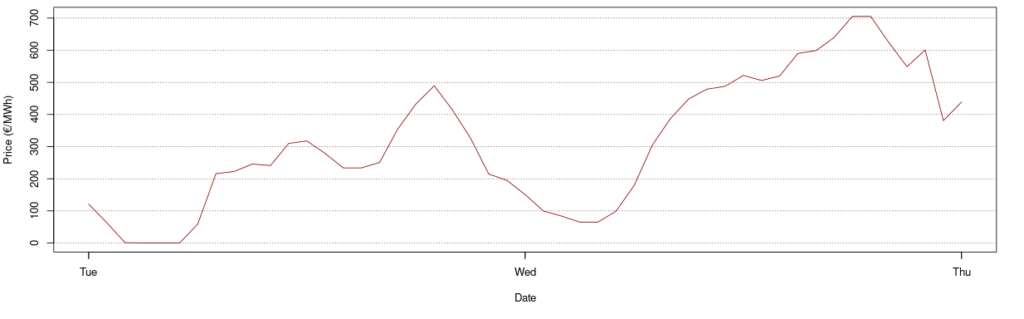

Let’s take Early March 2022 as an example:

The wholesale electricity price was zero in the early hours of Tuesday the 3rd of March. But prices rocketed throughout the day, topping a pricey €489 at 7pm. Prices next retreated to a reasonable €65 by 3am on Wednesday, before again streaking to a blistering €705.47 at 6pm.

Hot takes

Ireland’s high wind power capacity means that very low (or even negative) prices are common on windy nights. But on calms evenings, the price is set by natural gas. So high gas prices mean wild price swings in the Irish electricity market. This is a great situation for energy storage operators.

Energy storage investors should consider that their returns will likely be correlated with gas prices.

There are bargains to be had on the electricity market even in times of very high energy prices. Indeed, electricity prices were €0 or less for 99 hours during 2022. But consumers need the option of dynamic pricing to benefit from these opportunities.